Product

New Feature: More Conversions And Faster Turnaround For ACH Bank Account Checkouts

Dodd Caldwell

July 21, 2020

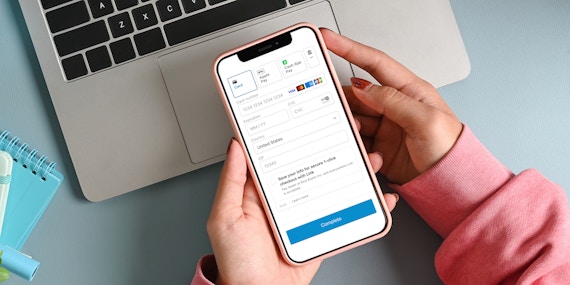

We’ve just launched major improvements to the checkout flow for ACH bank account payments. When payers are checking out with their bank account, the process is now much easier for them and it is instant (rather than taking days, as previously implemented.) So, you should see higher conversion rates for completed ACH checkouts and you should see your money quicker!

While these payments are still transacted through your Stripe account (our 3rd party payment provider), we are implementing a verification system from a company called, Plaid, to make this ACH checkout process easier.

ACH Recap

In May of 2018 we launched the ability for our US-based customers to accept payments through bank accounts through Automated Clearing House (ACH) payments.

ACH payments allow you to receive debit payments directly from a payer’s bank account instead of payers using credit or debit cards. Stripe, our third party payment processor, only charges 0.8% with a cap of $5 for ACH payments, making ACH a great option, particularly for higher dollar transactions.

There is no extra cost to you for this new ACH checkout experience.

Previous Checkout Flow

Our previous checkout flow involved the payer having to enter their bank account credentials, then having to check their bank account days later for 2 separate micro-deposits that they then needed to log back in and then confirm.

New Checkout Flow

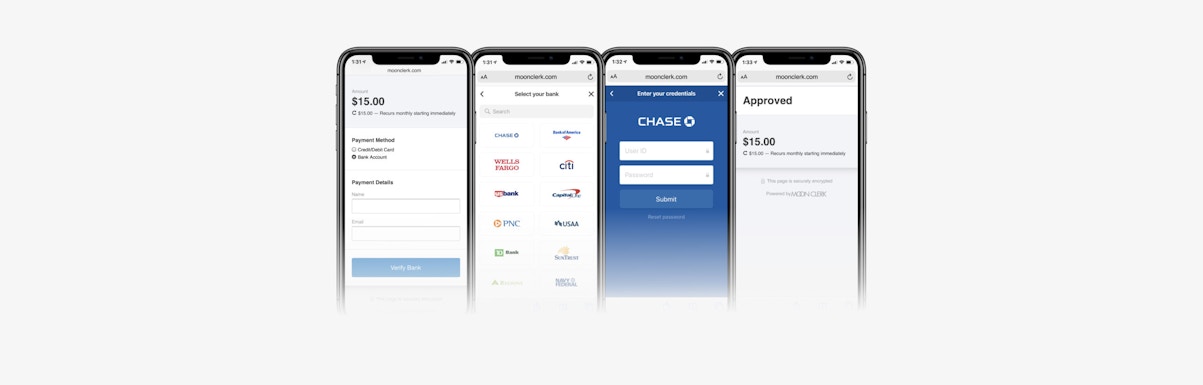

Checkouts are now completed instantaneously and with less effort from your payers.

Now, when your payers choose to pay with their bank account, they’ll be prompted to select their banking institution and enter their online banking credentials (username and password.) About 3% of payers will also need to enter their routing and account numbers.

That’s it. Their checkout is completed without you or them having to do anything else. So, you should expect to see a much higher conversion rate for ACH checkouts and more payers choosing the ACH option. And, it has 99% coverage in the US.

You can check out the header image of this blog post to see what the process looks like for most payers when they choose to pay with a bank account on your MoonClerk payment forms. Or you can check out our help document that explains the checkout process in more detail.

All of this still happens through your Stripe account – the third party payment processor we partner with.

Transfers

Keep in mind that with the ACH process, it can still take up to 5 business days to receive acknowledgment of the success or failure of the payment. But, because the actual checkout process is now instant instead of taking days, you should see your money quicker.

Differences Between ACH and Card Payments

Because banks handle ACH payments differently than card payments, there are differences to consider. Some of those are:

- It is more difficult for your customers to dispute your charges

- Payers on recurring plans cannot update or switch their bank account or payment methods. You would need to cancel their existing recurring plan and they would need to check out again.

- If a dispute is approved, there is no way for you to contest the dispute

- You can only issue refunds within 90 days of the original payment

- Refunds can take 2-5 business days to appear in your payer’s bank account

- If a payment on an ACH recurring plan fails, the system does not attempt to charge the bank account again

- If you have a new Stripe account, you may initially be limited to $2,000 per transaction. You can contact their support team to ask for this limit to be lifted.

Feedback

We hope these improvements to our ACH bank account checkouts will be beneficial to your organization. As always, if you have any questions, feel free to reach out to us at [email protected].